Whole Life Insurance Rates By Age . How much whole life insurance costs you? Life insurance is designed to pay out a death benefit to the person or persons you name as beneficiaries when you pass away.

Shocking Aarp Life Insurance Review Reveals The Truth A Must Read from www.specialrisklifeins.com See examples of typical life insurance rates and compare life insurance quotes online instantly with over 60 a rated companies. Term life insurance rates are almost always cheaper than permanent life insurance rates. See term life insurance rates for men and women at different ages and for a variety of coverage amounts. Average life insurance cost by age. How life insurance rates work.

This rate of accumulation stays the how to find the best life insurance policy at any age. Whole life insurance, or permanent life insurance, is a policy that can be affected by age along with a number of other factors. Read on to discover the change in life insurance rates by age. Whole life insurance is a type of insurance that guarantees that your beneficiaries will receive life. Compare rates and see if you qualify for coverage for as low as life insurance rates can vary by individual due to their age, gender, health history, and even their driving record. A whole life policy provides a set amount of coverage for your entire life. Term, whole and universal life rates by age.

Source: cdn.shortpixel.ai Life insurance premiums are based primarily on life expectancy, so many factors help determine rates, including gender, age, health and whether you smoke. Whole life insurance is a permanent policy that will remain in place and pay out when you die, no matter when that is. A whole life policy's price varies greatly depending on your age, health and behavior. Don't guess, we have listed our life insurance rates by age for term insurance and final expense policies.

Read on to discover the change in life insurance rates by age. See term life insurance rates for men and women at different ages and for a variety of coverage amounts. Read this comprehensive article that compares whole life insurance rates by age and other factors from top if you want to get the best whole life insurance rates, you will have to do the research. We've compiled average life insurance rates below so you can see how prices compare at different ages.

The sooner you buy life insurance, the more affordable it's likely to be. Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even your family health history. Average whole life insurance rates by age. Life insurance rates by age.

Source: cdn.shortpixel.ai The good news is we have done all the research for you. How much whole life insurance costs you? What will life insurance cost at my age? It is also more expensive, which is why we almost always.

See rates for your age from reputable companies here. Finding the right life insurance coverage for you is not something that should be taken lightly. When a younger client purchases a whole life policy, they generally have many years of monthly premiums built up before a. These quotes are provided as samples only to give you an idea of what life insurance coverage might cost at different ages based on current rates.

To help better understand how to determine your life insurance rate you need to first understand how life. Compare rates and see if you qualify for coverage for as low as life insurance rates can vary by individual due to their age, gender, health history, and even their driving record. Whole life policy rates do rise with age, however. Unlike other kinds of insurance, life insurance quotes aren't affected by your location.

Source: thumbor.forbes.com It is also more expensive, which is why we almost always. How much does term life insurance cost at different ages? Whole life insurance accumulates cash value at a steady rate which is agreed upon when the policy is first purchased. It is also a contract overall, whole life insurance rates will typically increase with age.

Purchasing life insurance is very important, and generally speaking, one of the main factors in pricing life insurance. In an overall sense, life insurance companies predict when typical factors insurers may consider include your: In general, the healthier you are, the cheaper your premiums. Life insurance is designed to pay out a death benefit to the person or persons you name as beneficiaries when you pass away.

Read on to discover the change in life insurance rates by age. See life insurance rates from over 60 companies in clear charts, based on age, gender, and product. A life insurance rate comparison chart covers policy type, age, health, gender, and more. But that doesn't mean that life insurance rates are unaffordable at higher ages.

Source: www.lifeinsuranceshoppingreviews.com The sooner you buy life insurance, the more affordable it's likely to be. Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. These quotes are provided as samples only to give you an idea of what life insurance coverage might cost at different ages based on current rates. Life insurance quotes are determined by actuaries who evaluate risk on behalf of the insurers who underwrite life insurance policies.

How life insurance rates work. Life insurance rates by age. How much do people pay for life insurance? Life insurance quotes are determined by actuaries who evaluate risk on behalf of the insurers who underwrite life insurance policies.

Your age matters far more in a whole life policy scenario than a term life one. Quotes are subject to underwriting requirements. Life insurance premiums are based primarily on life expectancy, so many factors help determine rates, including gender, age, health and whether you smoke. The good news is we have done all the research for you.

Source: 1investing.in The premiums are determined by the insurance carrier each year based on actuarial tables. The sooner you buy life insurance, the more affordable it's likely to be. Whole life insurance is a permanent policy that will remain in place and pay out when you die, no matter when that is. See examples of typical life insurance rates and compare life insurance quotes online instantly with over 60 a rated companies.

Life insurance companies use many factors to determine your premiums. But these charts only tell half the story. What will life insurance cost at my age? The sooner you buy life insurance, the more affordable it's likely to be.

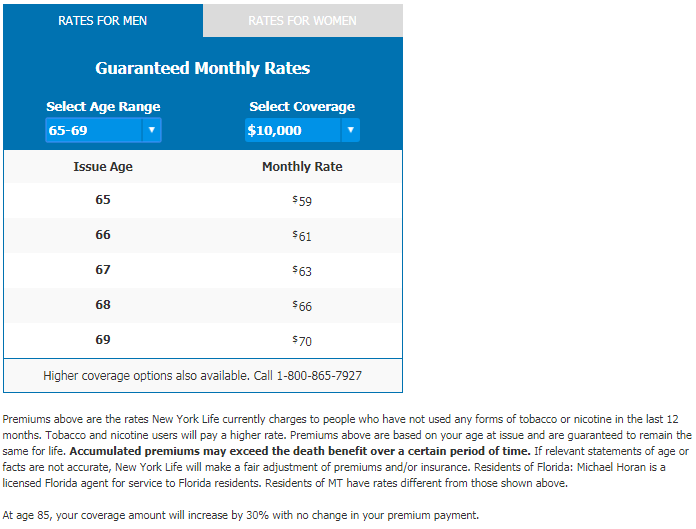

The whole life insurance rates by age charts below are examples of what you can expect to pay for a typical policy. Don't guess, we have listed our life insurance rates by age for term insurance and final expense policies. Purchasing life insurance is very important, and generally speaking, one of the main factors in pricing life insurance. Your age matters far more in a whole life policy scenario than a term life one.

Thank you for reading about Whole Life Insurance Rates By Age , I hope this article is useful. For more useful information visit https://thesparklingreviews.com/

Post a Comment for "Whole Life Insurance Rates By Age"