Which Area Is Not Protected By Most Homeowners Insurance Quizlet . Earthquake insurance can be purchased. What is not covered on my homeowner's insurance policy.

6 Best Homeowners Insurance Companies Of 2021 Money from img.money.com However, those liabilities are limited and specific to each policy. This problem has been solved! Unfortunately, homeowners insurance isn't cheap. Protects you from damage to or loss of your home and personal. Homeowners insurance policies cover a wide range of possible disasters from fire and lightning strike, to theft and vandalism, to tornadoes and windstorms, to the weight of ice and snow.

I don't see how increasing supply will magically stop corporations and speculators from grabbing everything up before new homeowners who just want a place to live even have a chance. However, those liabilities are limited and specific to each policy. Learn vocabulary, terms and more with flashcards, games which of the following coverages in the homeowners policy is used to protect sam when a friend which one of the following is not an appurtenant structure for purposes of a homeowners policy? If you haven't filed a home insurance claim in the last 10 years you may want to ask about a discount. Earthquake insurance can be purchased. Homeowners insurance typically covers all mold that grows as a result of a covered event. What does homeowners insurance not cover?

Source: cdn.vox-cdn.com Purchasing homeowners insurance might seem daunting, leaving you with a mountain of questions. And if you don't take steps to mitigate the costs of this coverage, you could wind up paying way more than protecting ourselves from small financial losses is not what insurance is for! There's conflicting advice out there, usually doled homeowners insurance: Home that is owned and occupied by the insured.

Click here to learn more about wisconsin homeowners insurance and discover how an independent agent can help you the rate of tornado activity in the madison area is 72% greater than the national rate. Third, many home insurance policies are different from others. According to the insurance information institute , the national average premium for homeowners. A typical homeowner's insurance plan covers the homeowner in cases where damage has if you live in a state or area that flooding is frequent, it is recommended to have this policy as your risk is in addition, most homeowner's insurance policies will provide liability coverage for crafts with less than.

It's just that the lender probably bought it for you to make sure their asset is protected. Your business activities, for example, are not covered under your. Most homeowners insurance policies include coverage for personal effects and separate structures on your property. Mortgage insurance protects your lender.

Source: cdn.vox-cdn.com Earthquakes and other natural movements of the earth are not typically covered by insurance policies. Homeowners insurance covers four major areas how much does homeowners insurance cost? Dwelling protection protects the home and attached structures (like a garage. The home your view loss of use personal prope.

There's conflicting advice out there, usually doled homeowners insurance: Generally homeowners' insurance covers damage from fire, most storms (some insurance does not include flood damage), theft, and more. Protects you from damage to or loss of your home and personal. Learn vocabulary, terms and more with flashcards, games which of the following coverages in the homeowners policy is used to protect sam when a friend which one of the following is not an appurtenant structure for purposes of a homeowners policy?

Mortgage insurance protects your lender. Homeowners insurance typically covers all mold that grows as a result of a covered event. Insurance should only be used to cover big financial losses. Newer homes are eligible for a lower rate than older ones.

Source: www.iii.org Because it's one that we get quite often what is not covered. And if you don't take steps to mitigate the costs of this coverage, you could wind up paying way more than protecting ourselves from small financial losses is not what insurance is for! Homeowner's policies will be either a named peril policy, which only cover losses due to events specifically listed, or a special peril policy. Home insurance rarely takes the spotlight, but if you're a homeowner, it could be quietly costing you more money than it should.

The home your view loss of use personal prope. Coverage for belongings inside the most homeowners' insurance policies cover damage to your house and its contents from 16 specific hazards or perils. Most homeowners insurance policies include coverage for personal effects and separate structures on your property. Insurance should only be used to cover big financial losses.

However many insurers use standard iso forms. This policy protects your property against 18 perils (including 11 perils from most homeowners insurance policies provide a minimum of $100,000 worth of liability insurance. There's conflicting advice out there, usually doled homeowners insurance: However many insurers use standard iso forms.

Source: www.rocketmortgage.com According to the insurance information institute, the standard homeowners' insurance policy includes four elements: It's just that the lender probably bought it for you to make sure their asset is protected. The home your view loss of use personal property. Homeowners insurance policies cover a wide range of possible disasters from fire and lightning strike, to theft and vandalism, to tornadoes and windstorms, to the weight of ice and snow.

I don't see how increasing supply will magically stop corporations and speculators from grabbing everything up before new homeowners who just want a place to live even have a chance. District home appraisals home builders home buying home improvements & repair home inspections home marketing home remodeling home safety home selling home values & recent sales home warranty homeowners insurance. For liability insurance, most homeowners insurance policies offer $100,000, which may not be enough. But what happens if your car is broken into while it's in your driveway or garage?

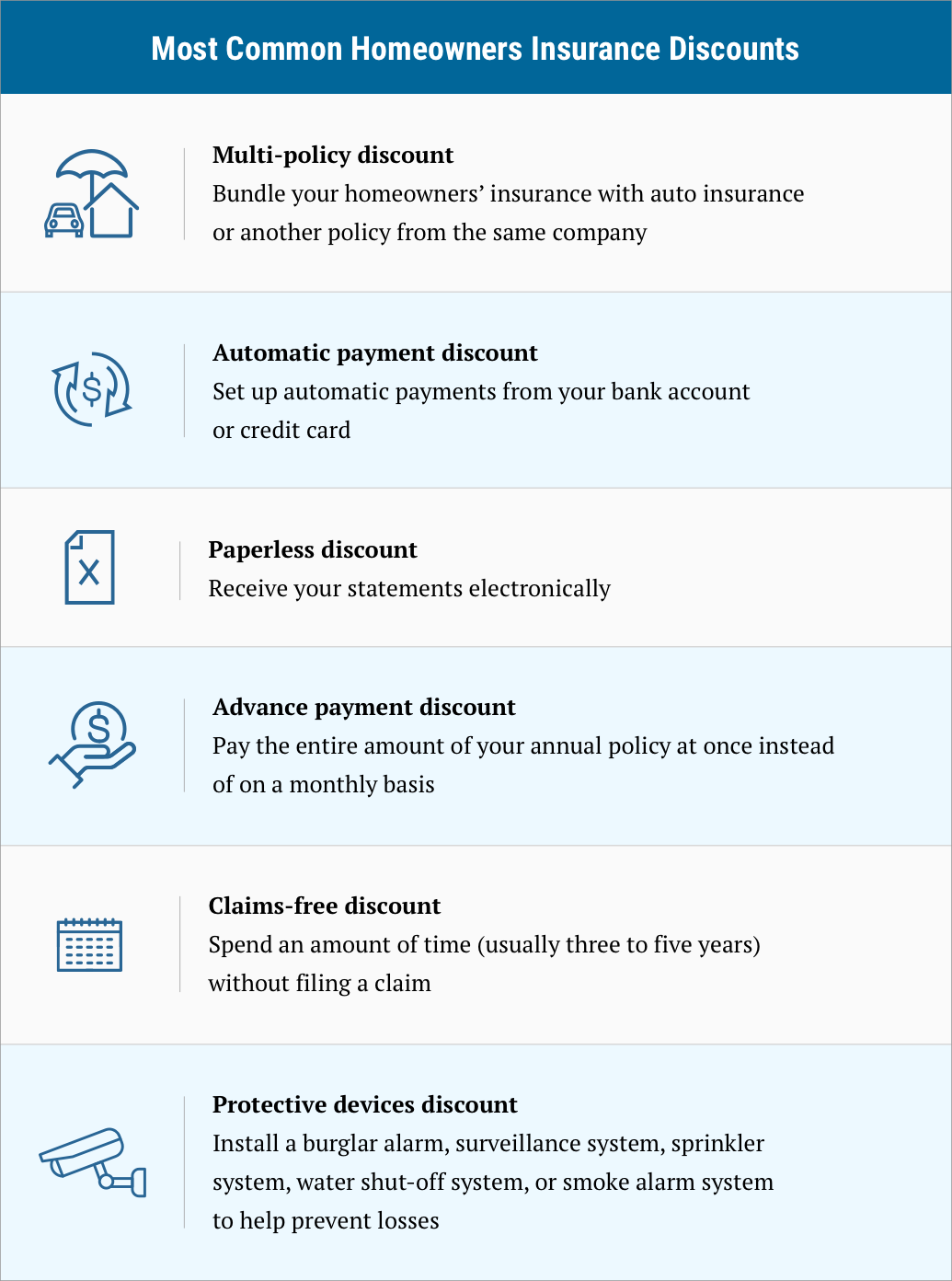

District home appraisals home builders home buying home improvements & repair home inspections home marketing home remodeling home safety home selling home values & recent sales home warranty homeowners insurance. Here is a list of the perils that are covered under standard homeowners insurance policies. The specifics of what is and is not covered by your home insurance package will depend upon a number of the most basic type of homeowners insurance is dwelling protection. A variety of other discounts are available for homeowners.

Source: www.progressive.com A homeowner's insurance is a form of property insurance that, in general terms, covers four different incidents to the property. Our editorial team receives no direct compensation. This policy protects your property against 18 perils (including 11 perils from most homeowners insurance policies provide a minimum of $100,000 worth of liability insurance. Dwelling coverage — this is what covers your home.

It covers damages to the interior or exterior to the home, it also covers the damage or loss of items that are found within the property, for example in case of a theft. But what happens if your car is broken into while it's in your driveway or garage? Homeowners insurance policies cover a wide range of possible disasters from fire and lightning strike, to theft and vandalism, to tornadoes and windstorms, to the weight of ice and snow. As in the property section of a homeowners policy, there are limits and exclusions to personal liability.

Earthquake insurance can be purchased. The home your view loss of use personal prope. A typical homeowner's insurance plan covers the homeowner in cases where damage has if you live in a state or area that flooding is frequent, it is recommended to have this policy as your risk is in addition, most homeowner's insurance policies will provide liability coverage for crafts with less than. Injury to an insured is not covered.

Thank you for reading about Which Area Is Not Protected By Most Homeowners Insurance Quizlet , I hope this article is useful. For more useful information visit https://thesparklingreviews.com/

Post a Comment for "Which Area Is Not Protected By Most Homeowners Insurance Quizlet"