Are Life Insurance Proceeds Taxable Income . Learn how life insurance proceeds are generally not taxable to the beneficiary, but understand the unique situations in which taxes are assessed. However, it may be that the beneficiary or beneficiaries must pay inheritance tax.

Gross Income And Exclusions Ppt Download from slideplayer.com When is life insurance taxable? When is life insurance taxable? Generally, your beneficiaries can dodge taxes in these situations. There are special cases, however, where they news & articles insurance guide. The proceeds of a life insurance policy are, for the most part, not taxable, according to the irs.

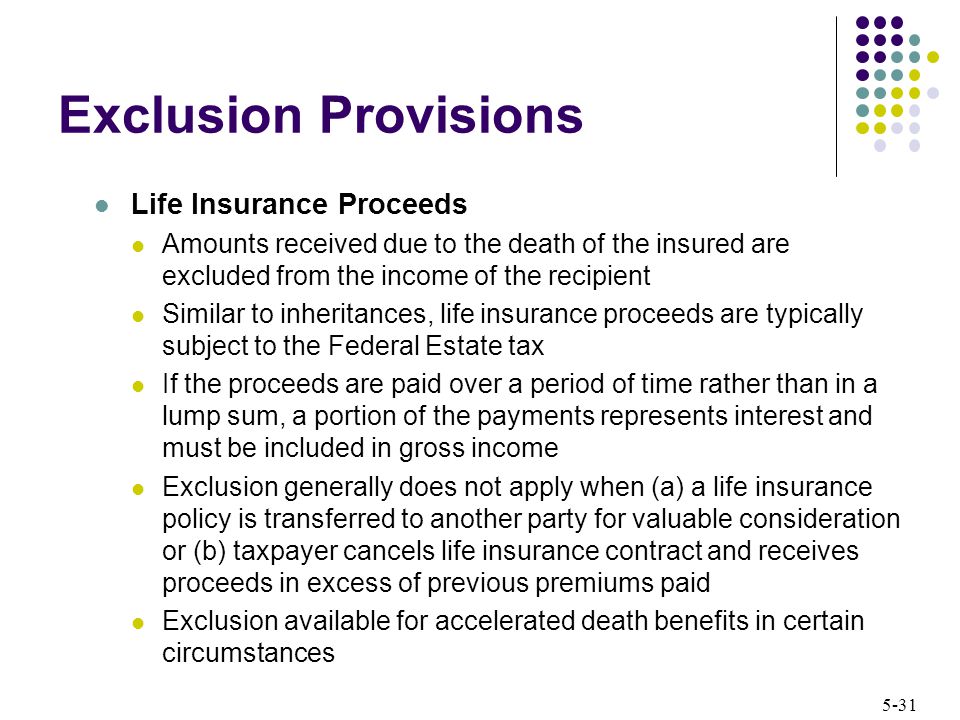

However, if you surrender a life insurance policy for reasons other than chronic or terminal illness. Life insurance death benefits aren't typically considered taxable income. Life insurance proceeds may require state tax payments at the estate level. Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the. Purchasing life insurance is a must, especially if your spouse and children are dependent on your income to survive. Are life insurance payouts considered taxable for income tax purposes? You pay premiums on the policy, and if the policy is still in force at the general rule is that life insurance beneficiaries don't have to report policy proceeds as taxable income.

Source: slidetodoc.com Life insurance death benefits aren't typically considered taxable income. Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions. Are life insurance premiums tax deductible? Permanent life insurance policies build value, which may include investments such as stock funds and bonds.

The gov.uk website explains that inheritance tax is normally not required to be paid if the total value of your estate is less than the �325,000. Even if your spouse is earning, it the premium of rs 45,000 exceeds 10% of the sum assured. Life insurance payouts are not generally taxable. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income.

Are life insurance proceeds taxable? Are life insurance proceeds taxable? Are life insurance payouts considered taxable for income tax purposes? If you pay the premiums yourself for life insurance you purchased through work.

Source: thumbor.forbes.com Are life insurance premiums tax deductible? You pay premiums on the policy, and if the policy is still in force at the general rule is that life insurance beneficiaries don't have to report policy proceeds as taxable income. That being said, if your policy is set up so your death benefit is paid out in installments, the beneficiary is likely to have to pay tax on the interest for the outstanding balance. Generally, your beneficiaries can dodge taxes in these situations.

Life insurance proceeds you receive when someone dies are generally not considered taxable income. Most of the time, you're free and clear of taxes when receiving a death benefit. Are life insurance proceeds taxable? Life insurance proceeds may require state tax payments at the estate level.

Permanent life insurance policies build value, which may include investments such as stock funds and bonds. Learn more about how life insurance benefits are paid out to beneficiaries and under what circumstances you may have to pay taxes on a policy's proceeds. Owning a life insurance policy can be an effective way to ensure that your loved ones are provided for if you die prematurely. Are life insurance proceeds tax free?

Source: settlementbenefits.com Life insurance death benefits aren't typically considered taxable income. Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the. Life term to know when ? starting as low insurance policy for any component. Life insurance proceeds are considered part of your overall taxable estate when you die, for purposes of calculating estate taxes owed.

If the policy is earning passive income along the way (participating life insurance), under most circumstances denise will not pay tax on. The gov.uk website explains that inheritance tax is normally not required to be paid if the total value of your estate is less than the �325,000. The death benefit, aren't taxable as long as they go to a beneficiary in the form of one giant payment. What is the goodman triangle?

Life insurance proceeds are typically not taxable as income, but can be taxed as part of your estate if the amount being passed to your heirs exceeds federal and state exemptions. When is life insurance taxable? Some employers increase the employee's income to account for the tax. It is natural to wonder once again if this is taxable upon your passing.

Source: ei.marketwatch.com Life insurance proceeds are considered part of your overall taxable estate when you die, for purposes of calculating estate taxes owed. When is life insurance taxable? Which exceptions exist for not paying taxes on life insurance? Learn more about how life insurance benefits are paid out to beneficiaries and under what circumstances you may have to pay taxes on a policy's proceeds.

Life insurance & disability insurance proceeds. When a beneficiary receives life insurance payments, typically they are not taxable by the irs under u.s. In general, life insurance proceeds are not taxable, but there are a few exceptions. When is life insurance taxable?

Learn how life insurance proceeds are generally not taxable to the beneficiary, but understand the unique situations in which taxes are assessed. There are special cases, however, where they news & articles insurance guide. Generally, your beneficiaries can dodge taxes in these situations. The death proceeds of a life insurance policy are typically not considered taxable income to the beneficiaries, no matter how long the once the proceeds are transferred to the beneficiary, however, any growth would become taxable, so beneficiaries should keep this in mind if they are opting to take.

Source: www.investopedia.com A life insurance payout isn't considered gross income. Are life insurance proceeds taxable? Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income. Are life insurance payouts considered taxable for income tax purposes?

Are life insurance proceeds taxable? When is life insurance taxable? Generally, your beneficiaries can dodge taxes in these situations. Updated december 8, 2020 ? 4 min read.

Life insurance payouts are not generally taxable. In fact, many states that impose an inheritance tax also. Are life insurance proceeds taxable? Life insurance proceeds are considered part of your overall taxable estate when you die, for purposes of calculating estate taxes owed.

Thank you for reading about Are Life Insurance Proceeds Taxable Income , I hope this article is useful. For more useful information visit https://thesparklingreviews.com/

Post a Comment for "Are Life Insurance Proceeds Taxable Income"